Axelar - The dark horse of the interchain race

Why is Axelar best positioned to capture value in a modular interoperability stack, and how can the Axelar Virtual Machine unlock an interchain future?

There are three main cross-chain arbitrary message passing (AMP) protocols in play today: LayerZero, Wormhole, and Axelar. In this article I will lay out 10 reasons why I believe Axelar stands as one of the strongest players in the cross-chain protocol space. My analysis will be organized according to three key aspects:

Fundamentals (i.e., the tech),

Financials (i.e., token economics and valuations),

Sentiments (i.e., narrative and hype).

Cross-chain protocols - some basics

Cross chain arbitrary message passing (AMP) protocols are interoperability solutions that allow for any piece of data, including tokens, the state of a chain, a contract call, an NFT, or governance votes, to be moved from chain A to chain B.

Axelar, LayerZero, and Wormhole are the three most notable cross-chain AMP protocols, all characterized by external verification. This means their interchain transactions are authenticated by third-parties who are not part of the involved blockchains. While there are other verification types for cross-chain bridges, like Natively Verified methods (such as L2 rollups and Cosmos IBC) and Locally Verified approaches (like Connext), our primary focus is on understanding these externally verified AMP protocols.

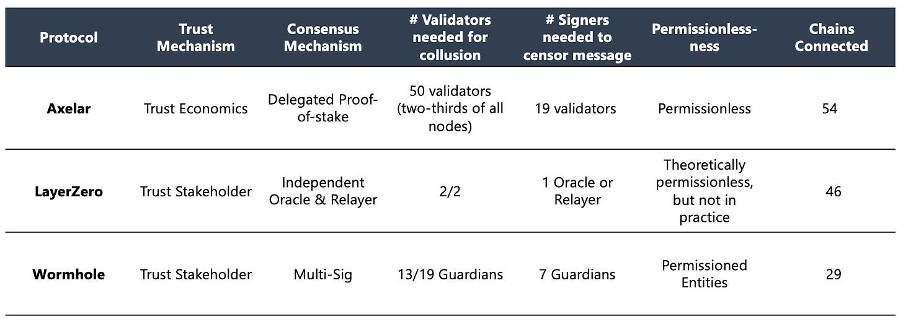

What makes these three protocols distinct in their approach, given they all employ external verification? The answer lies in their trust mechanisms. We can categorize these protocols into three groups: (1) Trust Stakeholders (human), (2) Trust Economics/Game Theory, and (3) Trust Math/Code.

Trust Stakeholders (human): This method depends on the reputation of certain entities to validate transactions.

Trust Economics/Game Theory: Validators are motivated to act ethically by the risk of losing staked collateral. The idea is that the economic loss from misbehaving outweighs any illegal gains.

Trust Math/Code: Uses on-chain light client verification with zero-knowledge tech and succinct proofs to verify one chain's state before transferring assets to another.

LayerZero and Wormhole both fall into the "Trust Stakeholders" category. Let's briefly explore their mechanisms:

LayerZero uses two types of validators: “Oracles” and “Relayers”. Oracle is essentially a contract address that can be notified to move a block header. It transmits block header information from the source to the destination network. Relayers submit proofs of message validity based on the block headers provided by Oracles. A message is deemed valid only when both Oracles and Relayers concur on its accuracy.

Wormhole utilizes a Proof-of-Authority (PoA) model where its security hinges on an external set of 19 validators called "Guardians". Guardians observe messages and sign the corresponding payloads. Each guardian performs this step in isolation, later forming a multisig which represents a proof that a state has been observed and agreed upon. The Guardians include notable companies like Figment, Everstake, ChainLayer and Certus One.

In contrast, Axelar is the unique one in terms of trust mechanism among the three:

Axelar operates on a delegated proof-of-stake (PoS) mechanism with the Cosmos SDK and uses crypto-economic guarantees for security. It has a permissionless set of 75 validators coordinated via Tendermint. Validators are incentivized for honest performance with block rewards, facing penalties for breaches or prolonged downtime. The protocol's reliability is underpinned by the validators' financial commitments and established governance mechanisms within the protocol. Axelar validators also use threshold signature schemes (TSS) to collectively maintain accounts on various blockchain.

To simplify:

LayerZero: Trust is placed in 2 entities that operate relayer and oracle.

Wormhole: Trust is placed in around 19 permissioned Guardians.

Axelar: Trust in placed in the economic guarantee from 75 validators’ stakes.

I. The Fundamentals

#1 Axelar stands out as the most trust-minimized cross-chain protocol

From the last section we can already see how Axelar stands out for its minimal trust requirement. Let’s explore Axelar, LayerZero and Wormhole’s architecture in comparison more closely.

LayerZero's architecture revolves around an "oracle" and "relayer”. The Oracle fetches block headers – summaries of blockchain blocks – from Chain A and sends them to Chain B for mutual state verification. In theory this is permissionless and anyone can be an oracle, Currently, Google Oracle is the default one with Chainlink as another option. Relayer provides proof of events on Chain A for Chain B to act upon. Importantly, the relayer ensures both security and execution. Theoretically, relayers are permissionless and can be run by anyone, but in practice operated by LayerZero.

This is why LayerZero’s architecture is sometimes mocked as a “2 of 2 multisig”. The bridge's integrity depends on the oracle and relayer's independence, which could withhold data to censor messages. While LayerZero allows custom Oracle and Relayer setups, in practice, setting up a personal Oracle and Relayer is challenging and costly, so it’s rarely done. Thus, the default configuration relies on the trust into a few entities, therefore causing security, liveness, and censorship resistance limitations.

Wormhole uses a Proof-of-Authority model, more decentralized than LayerZero but still permissioned. It relies on 19 "Guardians" from permissioned entities. The cross-chain messages are deemed valid when 13 out of 19 validators agree on them. The protocol includes a 'Governor' function to pause large transactions, adding a layer of security. However, the involvement of entities like the former validator FTX underlines the potential pitfall of relying on reputational trust alone.

Axelar is unique in its trust approach, relying on economic guarantees with a network of 75 active validators, offering higher decentralization. In scenarios where stake is dominated by a few in a PoS system, quadratic voting of Axlear plays a crucial role in maintaining decentralized decision-making.

Typically, blockchain governance operates on a "one token = one vote" principle, where voting power increases linearly with token holdings. However, Axelar's quadratic voting mechanism increases the cost of each additional vote, effectively curbing centralized power and encouraging a more balanced distribution of influence.

The protocol mandates a 60% consensus across the entire validator set for validating any cross-chain message. This threshold ensures that the validity of messages doesn't depend on the size of a specific subset of validators servicing a particular chain.

Furthermore, Axelar has instituted a rate-limiting feature to enhance network security. By setting a cap on the total value of assets that can be transferred through Axelar within a given timeframe, the network effectively minimizes potential damages from any unforeseen incidents. Application-level security add-ons of Axelar also allows developers to create custom security rules. For example, a DeFi app could set specific limits on fund transfers, transaction frequency, and large transfers.

#2 Hub & spoke scales better than point-to-point

Axelar adopts a Hub & Spoke network topology for its cross-chain architecture. This is in contrast to LayerZero's point-to-point design.

Let’s imagine cross-chain messaging as an airline's flight system: just as long haul flights are routed through central airports in big cities, Axelar channels messages and transactions through a central platform - the Axelar PoS chain. This approach results in fewer connections to operate, streamlined monitoring, and easier upgrades.

Another mental model is to think of Layer Zero as akin to two-way radios, establishing direct connections between two users. In contrast, Axelar operates more like a cellular network, where communication is routed through cell towers (representing the hub) to reach various endpoints. This reflects in its adaptability and configurability.

In a Hub & Spoke model, we can see that the network connections are much “tidier”. But beyond “neatness” in organization, it’s also about cost efficiency and effective management. In fact, we can see that in the real world, many systems are organized in a hub & spoke model:

Healthcare Networks: Central hospitals (hubs) offer specialized services like trauma care, while local clinics (spokes) provide basic care and diagnostics. This setup ensures specialized services are centralized for efficiency while basic needs are accessible locally.

Library Systems: A main library (hub) houses extensive collections and resources, while local branches (spokes) address community-specific needs, ensuring broad access with specialized resources.

Foreign Policy: Post-World War II, the U.S. foreign policy adopted a Hub & Spoke alliance system in East Asia, with the U.S. as the central "hub" and smaller countries as "spokes" in a network of bilateral alliances.

Another advantage is that a central hub allows for efficiency during a crisis. In a point-to-point network, isolated connections may fail to detect simultaneous threats. Axelar mitigates this risk by centralizing interactions, thereby enhancing network security and responsiveness. For instance, when Multichain, a another bridge protocol, was disrupted due to the detainment of its founder, cross-chain swap services built using Axelar were able to stay safe and liquid by isolating compromised connections.

The obvious critique of Hub & Spoke is its centralization risk: if the hub fails, the entire network suffers. In Packy McCormick’s in-depth report on LayerZero, its founder Bryan pointed out:

(For the cross chain protocols…) There’s a middle chain – Cosmos, Axelar, Wormhole, whoever – that listens to events, says “yes/no” to validity, and sends a message. Everyone trusts the middle thing, and if that’s corrupt for even a matter of blocks, it can corrupt everything that touches it.

The key here is that a central component is inevitable in cross-chain networks. While LayerZero emphasizes direct, two-way communication, it still relies on some form of 'middle thing'. Axelar recognizes that forcing originally non-interoperable blockchains into this role is a fundamental flaw of point-to-point systems. 0xpostman sums it up well:

The core insight here is that in a point to point system, the L1 blockchains which are being connected are actually the hubs. Most blockchains are not designed to be interoperability hubs, and to use them as such is a mistake.

Another advantage of the Hub & Spoke model is its scalability. In a network comprising 'n' nodes, only 'n – 1' routes are needed to connect all nodes in a Hub & Spoke system. For instance, a system with ten destinations requires just nine routes to interconnect all points. Conversely, a point-to-point system with the same number of destinations would necessitate 45 routes for full connectivity. As we anticipate a future proliferated with L1, rollups, and app chains – a state of "let a hundred chains bloom" – the point-to-point model's limitations become apparent.

#3 Axelar Virtual Machine (AVM) will advance Interchain Dapps

Developed on Cosmwasm, Axelar Virtual Machine (AVM) transforms interoperability into a programmable layer. It empowers developers to write smart contracts directly on Axelar, scaling their interchain projects while enabling the abstraction of cross-chain tasks such as token conversions to reduce developer overhead. The AVM include the following features and capabilities:

Permissionless Connections to New Chains: The AVM enables permissionless connections to new chains, allowing for the automation of technical overhead required for integrating new blockchains. This feature, known as the Interchain Amplifier, streamlines the process of supporting new chains by incentivizing validators through third-party sources pooling AXL tokens.

Interchain Maestro – This tool empowers developers to deploy and manage multi-chain dApp instances. Interchain Maestro's 'build once, run everywhere' philosophy simplifies development. A recent update saw the Interchain Token Service (ITS) moving to testnet in July. ITS extends tokens across chains while maintaining their native attributes, offering teams the simplicity of minting tokens and managing supply and functionalities.

So what does the terminology actually mean? What is the real stuff that can be built? Ben Weinberg from Axelar has provided a few ideas in a community forum post:

Interchain Liquidity: Distributing liquidity across chains to enhance liquidity on smaller networks.

Interchain Yield Optimization: Maximizing yield opportunities across the DeFi protocol on multiple chains.

Interchain Staking: Facilitating staking across multiple blockchains.

Universal Wallet: Creating a wallet that has a unified token balnce that actually operates across chains under the hood.

Interchain Marketplace: Building NFT marketplaces that integrate multiple blockchains.

Axelar, with the AVM, is well-positioned to support the transition to interchain applications where apps are designed to operate seamlessly across multiple chains, breaking the barriers of isolated networks. In fact, we are seeing some examples already:

Sommelier is a multi-chain yield vault developed on the Cosmos SDK and bridges high-value EVM networks. Its vaults dynamically adjust composition based on market conditions or set metrics, leading to more adaptable and profitable strategies. Sommelier leverages Axelar for bridging to alternative EVMs, allowing interaction with smart contracts in their native environments for executing rebalances.

Ojo is an interchain oracle network built on the Cosmos SDK and using Tendermint BFT for consensus, specializes in aggregating and relaying data from decentralized sources across blockchains. Validators on Ojo can proactively provide approved data feeds and are rewarded for their contributions. Ojo utilizes Axelar's cross-chain smart contracts and IBC protocol to relay pricing information efficiently. Validators provide real-time data on asset prices, which is aggregated and verified on-chain.

#4 LayerZero v2 reveals Axelar as the true “layer 0”

The naming of LayerZero is a stroke of marketing genius. It implies the concept of a Layer 0 (L0) in blockchain - suggesting an interoperability layer operating beneath Layer 1 blockchains. However, a name alone doesn't define the functionality. Despite its name, LayerZero functions more at the application level in the interop stack, whereas Axelar, though not explicitly named as such, aligns more closely with the true essence of a Layer 0 protocol. This is become more evident with its recent launch of LayerZero v2.

Let’s go back to the detailed analysis by Not Boring which draws comparisons between LayerZero and the TCP/IP protocol:

“If TCP/IP was the enabling protocol for the Internet, I think that LayerZero can be the enabling protocol for the Omnichain – a network of blockchains, each leaning into its own points of differentiation”

If we look closer, within the TCP/IP model, there are still different functions. TCP/IP is a layered server architecture system in which each segment is defined according to a specific function. All these four layers work collaboratively to transmit the data from one layer to another.

Application Layer: As the topmost layer, this is where user interaction and data generation occur. It encompasses protocols like SMTP for email, HTTP/HTTPS for web browsing, FTP for file transfers.

Transport Layer: This layer establishes reliable and error-free connections. It segments data into packets and orchestrates their orderly and precise delivery.

Internet Layer: Also referred to as the IP layer, its primary role is in packet transmission and routing across the network. It utilizes protocols like IPv4/IPv6 for routing data through various networks.

Network Access Layer: This layer corresponds to the OSI model's data link and physical layers. It's concerned with the physical aspects of data transmission, handling tasks like MAC addressing and the management of Ethernet cables, wireless networks, network interface cards, and drivers.

LayerZero's design primarily operates at the application or transport layer, acting more like a wrapper on top of existing protocols. To continue quoting from Not Boring:

“LayerZero is solely the transport layer, and Wormhole is also the verification layer. Because of that, Uniswap could swap out Chainlink for its own verifier set. With Wormhole, if you want the pipes, you also need to use its 13-of-19 Guardian model.”

“We felt like the Uniswap forum was more of a failure on our part to properly message the protocol and the role it plays,” Bryan told me. “They expected us to be a Wormhole or an Axelar and we just fundamentally aren’t.”

In the newly announced LayerZero v2, one of the most important changes is that Oracles and Relayers are replaced by “Decentralized Verifier Networks” (DVN) and “Executors” , which are which are permissionless to run:

“Now, any external network can be a DVN, and applications can choose any combination of them to approve messages. At launch, Animoca, Blockdaemon, Delegate, Gitcoin, Nethermind, Obol, P2P, StableLab, Switchboard, Tapioca, SuperDuper, Polyhedra, and Google Cloud are confirmed DVN options, and adapters have been built to hook in Axelar and Chainlink’s CCIP. Adapters for other bridges, including Wormhole, are on the roadmap.”

Critical to Axelar's functionality, its validator nodes provides security - the platform employs an intermediate consensus layer. This layer sets a universal standard for consensus across all Axelar message transfers, differing from LayerZero's approach that leaves rule and consensus definition to individual dApps. Axelar provides a structured framework for messaging, whereas LayerZero offers dApps greater flexibility.

Chia Jeng Yang (from Pantera) succinctly captures this in his blog Messy Problem:

LayerZero is not prescribing the full security profile that multi-chain dapps will use, but rather takes a modular approach to allow dapps to decide how much security they want to design and adopt, with the burden of security design choices on the developers.

While LayerZero is “thinking about security by not thinking about security,” Axelar, owning its full stack, opens up numerous opportunities for value capture at various layers, including network, services, and infrastructure (such as relay and gas services). In contrast, LayerZero doesn't control the underlying layers.

Another perspective to look at the interoperability protocols through a modular lens. Similar to the modular blockchain thesis where the function of a blockchain is separated into execution, settlement, consensus and data availability layers, we can also divide cross chain protocols into modular blocks that service various functions:

Application: Interpreting data in a standard schema

Transport: Moving the data from one domain to another

Verification: Insuring the validity of the data being passed

It’s not hard to see that the most crucial element here would be the verification part, which refers to the process of ensuring that the information on the state received by chain A and chain B corresponds to the agreed and valid state of each chain. This is crucial when both chains take actions based on each other's states. With LayerZero v2, this element is essentially outsourced to other entities. Axelar, in contrast, provide a robust network that services this verification layer.

#5 Wormhole Gateway validates merits of Axelar’s architecture

We have extensively discussed LayerZero, but what about Wormhole? Valued at $2.5 billion in the private market and with a strong presence in Solana and Move-based chains like Sui/Aptos, how does it stack up against Axelar?

Wormhole shares similarities with Axelar, particularly in its Hub & Spoke model. If we continue with the mondular interop protocol anology, Wormhole also operates at the verification layer, providing actual consensus. While there are differences in their trust mechanisms—Wormhole relies on the reputation of guardians, and Axelar on economic stakes—their distinctions mainly lie in ecosystem focus and business strategy.

Wormhole focuses on bridging EVM and Solana ecosystems, while Axelar, being a Cosmos chain, focuses more on the Cosmos ecosystem. Notably, both Wormhole and Axelar received approval to be used by Uniswap Governance in their in-depth bridge assessment report. (Sidenote: LayerZero was not approved due to concern about level of centralization).

But what is very interesting is that Wormhole has recently announced Wormhole Gateway. Let’s look at the announcement:

“The Wormhole Gateway is an application-specific blockchain developed within the Cosmos ecosystem that serves as a bridge to connect multiple Cosmos chains and applications through a single cross-chain liquidity router.”

Sounds familiar right? Doesn’t this sound like Axelar in practice? Wormhole has decided to start its own chain called Gateway using Cosmos SDK which will enable users to access over 23 blockchains with one IBC-based liquidity router. It also acts as a sovereign verification layer for Wormhole messages, adding an extra layer of security to the network:

The Gateway aims to provide a more efficient and cost-effective way for users to move their funds between different blockchains, with zero additional bridging fees. It is a significant advancement from the Wormhole bridge, a prior decentralized protocol known for its capacity to connect multiple blockchains.

Since its announcement in July, updates on Wormhole Gateway’s development have been sparse. Its emergence suggests increased competition for Axelar, especially in EVM <> Cosmos chain flows.

Yet, the design similarities of the Gateway—using Cosmos SDK and an IBC light client—serve as a testament to Axelar’s architectural choices. It seems Wormhole is now also eyeing a share of the same market, underscoring the validity and appeal of Axelar's approach.

II. The Financials

#6 AXL token economics enhancement reduced inflation

The AXL token on the Axelar Network has three primary functions with the the initial token distribution is as follow.

Fees to pay for the network usage, e.g. transaction fees.

Incentives for securing the network through staking.

Governance for stake-weighted voting.

Recently a new token economics proposal introduced two important measures that enhance its sustainability.

Reduced Network Inflation

Previously, the inflation rate of the Axelar chain was 0.75% per externally verified chain, leading to a total inflation of 11.5% (based on 1% base inflation and 14 externally supported chains, each contributing an additional 0.75%). This resulted in an AXL staking APR of about 14.5%.

On Dec 9, 2023, a new proposal was passed, reducing the inflation to 0.3% for each external chain. This adjustment lowered the total inflation to 6.7%. This reduction aims to balance validator incentives with a controlled expansion of the network’s supply.

Gas burning mechanism

In Axelar's, cross-chain transactions are subject to gas fees paid in AXL, which are then redistributed to stakers. Typically, processing a message through Axelar costs about 0.2 AXL. A medium-term proposal, yet to be voted on, suggests removing these gas fees from the circulating supply.

This gas burning mechanism is expected to counterbalance inflation over time. For instance, with a fixed gas fee of $0.5 per transaction in AXL equivalent and a fee of 5 basis points for certain asset volume transfers, the network could remove approximately 104 million AXL (around $36.5 million at current rates) from supply annually. This would be based on processing 100,000 transactions per day and handling a daily volume of $100 million. Such a mechanism could effectively neutralize an inflation rate of up to 10%.

However, it's crucial to note that Axelar has not yet achieved this scale, with recent figures indicating about 4,000-5,000 transactions per day and a daily volume near $20 million. But, moving forward with this proposal could align AXL tokenomics closer to Ethereum's model, where issuance and burning activities equilibrate, potentially setting Axelar on a deflationary trajectory.

#7 Market hasn’t realized Axelar’s positioning as an overlay network

When evaluating Axelar in comparison to other AMPs, it's natural to consider its valuation relative to them. Based on private market raises, LayerZero and Wormhole are valued at $3 billion and $2.5 billion respectively. If we crudely compare these figures to Axelar's current $1.1 billion FDV, it suggests a potential for a 2x+ upside for Axelar.

However, our analysis has shown that LayerZero aligns more with an application layer rather than a foundational networking layer. Its v2 with DVN structure indicates that Axelar could underpin its oracle/relayer infrastructure, acting as the true network layer that offers security.

Regardless of one’s stance on the fat protocol thesis, the market still appears to value infrastructure protocols at a premium. Wormhole, on the other hand, is moving towards a model similar to Axelar’s by developing its own chain, yet Axelar is significantly ahead in this development.

I’d like to draw attention to an analogy used by Axelar’s founder, Sergey, who likens Axelar to an overlay network. This concept hasn't fully penetrated crypto’s vernacular, but overlay networks were a crucial step in the early development of the commercial internet, providing services and rich content delivery beyond what protocols alone could guarantee. I predict that the maturation of the Axelar Virtual Machine (AVM) and interchain dApps will increasingly distance Axelar from being seen merely as a cross-chain messaging protocol.

Instead, Axelar will be recognized as a distinct entity - a comprehensive interchain overlay network on top of all L1s, L2s, application chains, and roll-ups that provides app deployment, routing, translation, and security between all blockchains, enabling true interoperability.

The market's understanding of Axelar's vision for chain abstraction might become clearer with the success of an interchain application, like a universally compatible wallet. Extending Haseeb's analogy of "blockchains as cities" to nations, Axelar can be likened to the extensive underground internet cables that weave the entire world into a single information network. In this scenario, LayerZero would resemble point-to-point shipping lanes, navigating the ocean using systems built on the network of cables for navigation and communication.

III. The Sentiments

#8 Axelar continues to make waves in dapp partnerships

On business development, Axelar is rapidly forging partnerships with DeFi protoocls to enhance cross-chain functionality:

Frax Finance: Axelar and Frax are joining forces to improve the cross-chain user experience. This partnership will see the launch of an axlUSDC-FRAXBP Curve pool on Arbitrum, with a commitment to contribute $5k monthly towards pool incentives. Furthermore, Frax Finance will integrate axlUSDC and Frax across its product suite.

Vertex: Axelar and Vertex have recently announced a collaboration aimed at advancing cross-chain interoperability. This integration allows users to conduct smooth cross-chain deposits on Vertex, utilizing Axelar's network and Squid.

dYdX Integration: dYdX has partnered with Axelar and Squid to facilitate one-click onboarding for users on its v4 platform. This integration allows users to easily deposit or withdraw to a dYdX Chain address from any blockchain lleveraging Axelar's cross-chain infrastructure.

Lido & Neutron: This collaboration aims to boost cross-chain interoperability and support the expansion of Lido's liquid staking token, wstETH, into the Cosmos ecosystem. Axelar and Neutron have been chosen by Lido as the preferred technology partners for bridging Lido's wrapped liquid staked ETH (wstETH) to the Cosmos network.

#9 Increasing flow between EVM <> Osmosis & Cosmos chains

Axelar is the leading protocol for bridging EVM and Cosmos chains, notably Osmosis. Recent trends shows that Osmosis is re-gaining traction.

0xArthur from DeFiance Capital posits that Osmosis is strategically positioned to benefit from the expanding Cosmos ecosystem. Recent launches like $TIA have already boosted daily volumes by 50-100%. Moreover, there's a prevailing bullish sentiment surrounding the entire Cosmos ecosystem, particularly with the dYdX chain launch and the anticipated rise of Noble USDC/WBTC. As the primary liquidity hub for Cosmos-based assets, Osmosis boasts $122m in Total Value Locked (TVL), further cementing its status.

An analysis by 0xhopydoc from Mobius Research presents a compelling thesis for "fat" app chains such as Osmosis. It suggests that app chains are cultivating their ecosystems to harness the best of being both a protocol and an app. The analysis touches on why Osmosis is positioned to initiate a positive feedback loop, potentially becoming a leading liquidity hub as it methodically builds an ecosystem around its AMM-based app chain. This includes integrating DeFi primitives like Mars Protocol for a money market and Levana Protocol for perpetual futures exchanges, among others.

Recent data on Axelar indicates a noticeable uptick in activities over the last 30 days, specifically linked to Osmosis-related connections. This trend underscores the growth in flow between EVM, Osmosis, and other Cosmos chains, highlighting Axelar increasingly important role.

#10 LayerZero airdrop will bring attention to interoperability protocols

I admit the final reason might seem a bit contrived as I aimed for a neat list of ten, but it's worth noting that airdrop expectation in LayerZero and Wormhole may draw significant attention to cross-chain protocols.

Earlier this month, LayerZero confirmed an airdrop scheduled for the first half of 2024, stirring excitement within the community.

Additionally, there's growing speculation about a potential Wormhole airdrop and token launch. A document from February 2023 detailed plans for the private token sale targeting institutional investors. The sale of 750 million HOLE tokens, representing 7.5% of the total supply at $0.25 per token, raised about $187.5 million, valuing the project at $2.5 billion.

The anticipation of these airdrops and token launches in 2024 is expected to significantly heighten interest in cross-chain protocols. If the tokens trade above their private market valuations of $3 billion and $2.5 billion, respectively, it could prompt a re-evaluation of Axelar's worth, potentially aligning it closer to its counterparts.

What about the risks?

Cross-chain protocols are frequently targeted by malicious actors due to their lucrative nature. Common risks include fund drainage, unauthorized token minting, and fraudulent transactions. The root causes of these exploits can vary widely, from rug pulls and compromised bridge permissions to exposure of private keys and ownership takeovers.

Axelar faces similar security challenges, which, while they can be minimized, can never be entirely eradicated. Axelar employs a lock and mint mechanism for token bridging. According to Axelarscan, there are approximately $150 million locked in Ethereum’s Axelar Gateway contract, a significant sum that could attract hackers.

A security report in April by LlamaRisk highlighted that the Gateway contract could be upgraded by a 4-of-8 multi-sig, which essentially has custody of the funds locked in Axelar and the ability to impose transfer rate limits.

“The 4-of-8 multi-sig controls contract upgrades, which effectively gives it custody of funds locked in Axelar. Additionally, it has the power to impose transfer rate limits.”

However, since June, Axelar has taken steps in decentralizing the network by allowing the validator set to jointly approve smart contract upgrades. This move has addressed one of the major security concerns for Axelar, also emphasized in Uniswap’s bridge assessment report.

Conclusion – what does an interchain future look like?

Consider the typical journey of a new crypto user today: first they buy stablecoins on a CEX with credit card or bank transfer, then they buy some tokens like SOL or ETH. Then they get interested in NFTs and DeFi and want to play with on-chain dapps. Now they encounter a daunting menu of networks to choose from during withdrawal.

Expecting them to discern the nuances between withdrawing USDT to TRON (cheap and fast but with no dapps) or to Ethereum (expensive and slow but with best liquidity) or zkSync (cheaper and faster Eth L2) is unrealistic.

The situation gets even more convoluted with assets like SOL on CEX such as Binance, where users can withdraw SOL on the BNB chain. Here, there is the extra complexity that SOL exists natively only on the Solana chain, and what they receive on the BNB chain is a wrapped version recognized only by the Binance exchange. Such complexity confuses the newcomers and seasoned users alike.

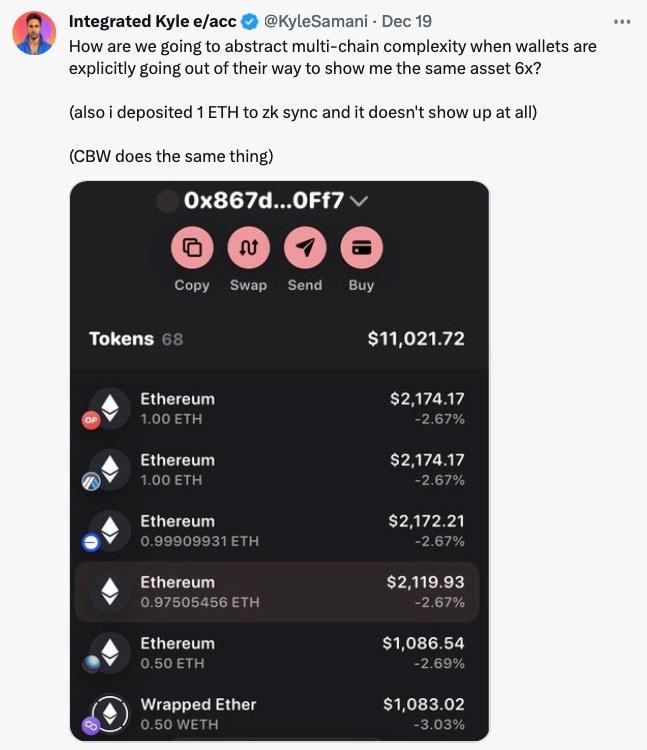

Kyle from Multicoin Capital has also voiced frustrations over the confusion of multi-chain balances, a common interface in most of the wallets today.

This complexity stems from the fact that the specific chain hosting your token still matters. The user interface remains complex as underlying liquidity is fragmented, and application logic is siloed chain by chain. This scenario is unlikely to change until the advent of true interchain dApps facilitated by cross-chain AMPs.

Now, envision an alternative future powered by interchain wallets built on Axelar. In this future, users from a centralized exchange can withdraw any token via Axelar. Within a universal wallet, balances are unified; the distinctions between ETH on six different chains become irrelevant. Users interact with a singular ETH, and when they deposit into a yield vault like Sommelier, they maintain a single balance and position. Behind the scenes, the yield protocol uses Axelar to deposit their ETH into the most profitable pools or vaults across different chains.

This interchain future simplifies user experience, unifies fragmented liquidity, and harnesses the full potential of decentralized finance, marking a significant leap forward in blockchain’s usability. And that is a future of web3 I eagerly anticipate.

Resources

Axelar, Bridges, and Blockchain Globalization | by Haseeb Qureshi

Axelar Protocol — Explained by Multi-chain Talk

Messy Problems - The Three Debates of the Layer Zero (L0) Wars

Cyrpto EQ - Axelar Network: Enhancing Blockchain Interoperability

Acknowledgements. I would like to extend my gratitude to the individuals who have generously answered my questions, reviewed my draft, and offered valuable feedback @0xhopydoc, @galenmoore, @jason_c_ma.

Not financial or tax advice. The purpose of this article is purely educational and should not be construed as investment or financial advice.

Disclaimer. This article reflects my own opinion solely, not the views of my employer.