Winning the wallet war: 3 essential frameworks for builders and investors

As the competition heats up, which web3 wallet stands tall? Three frameworks to assess the landscape.

Introduction

Web3 wallets serve as the primary gateway to on-chain services, enabling users to interact with dapps and store their digital assets. With over 350 wallets featured on WalletConnect’s website, it’s evident that this domain has become one of the most saturated sectors in crypto. The reason for this saturation is clear: wallets represent the initial touch point for all things on-chain, and it’s well understood that with distribution comes great power.

In this article, I won’t delve into the technological nuances by categorizing wallets into EOA, AA, MPC and ERC-4337 etc. While these technical classifications hold importance, they typically represent differentiation only within a specific layer of a wallet. Instead, my focus here is to present three frameworks that offer insights into the business and strategic positioning of web3 wallets. These frameworks will equip both builders and investors with a clearer understanding of the wallet ecosystem, addressing questions like: How can existing projects in this saturated market capture additional value? What strategies could newcomers adopt to carve out their space amidst established giants? And, which segments in the wallet market are still up for grabs? These are the considerations that will guide our discussion.

I. ‘One wallet fits all’ vs. ‘Niche master’

In this analysis, I plot major wallets along two distinct axes: feature specificity and the breadth of blockchain ecosystem coverage. While this categorization isn’t strictly quantitative or scientific, it draws from my hands-on experience with these products. Rather than focusing on a wallet’s exact position on the grid, it is more useful to observe the general quadrant they occupy. For instance, wallets catering to Move-based chains, and Bitcoin Ordinals ecosystem, sit lower on the graph due to their ecosystem-specific focus. On the other hand, wallets tailored for niche use cases such as trading, staking and social, lean towards the right, indicating their specialized nature.

This framework segments the landscape into four distinct categories:

Top Left: A highly competitive zone with wallets striving for an all-encompassing approach. Here, we find wallets aiming for a "one-size-fits-all" strategy, seeking to offer all primary features, utilities, and chains. Typical players in this quadrant include CEX affiliated apps such as Trust (Binance), Coinbase Wallet, OKX, Bitget Wallet etc.

Top Right: While these wallets maintain a broad chain ecosystem coverage, they don't chase every available feature. Instead, they specialize in use cases that cater to the most active user groups. For instance Zerion and Zapper offer consolidated DeFi portfolio tracking functions. In the case of Rainbow, it has a more NFT-centric tilt with feature like minting in-app.

Bottom Left: Here lie wallets with a discernible ecosystem inclination. Though they might support multiple chains, their allegiance leans towards particular ones—like Phantom's tilt towards Solana, or Core Wallet’s bias towards their Avalanche and its subnets despite backing other EVMs. Their objective is to secure an early foothold in rising chains and build a loyal user base from the start.

Bottom Right: The 'niche masters', these wallets hone in on specific features with clearer targets on desired user activities like staking and swaps. Their support for chains is selective, directing their resources towards supporting chains with most activity/liquidity that could offer promising ROI.

II. The wallet stack

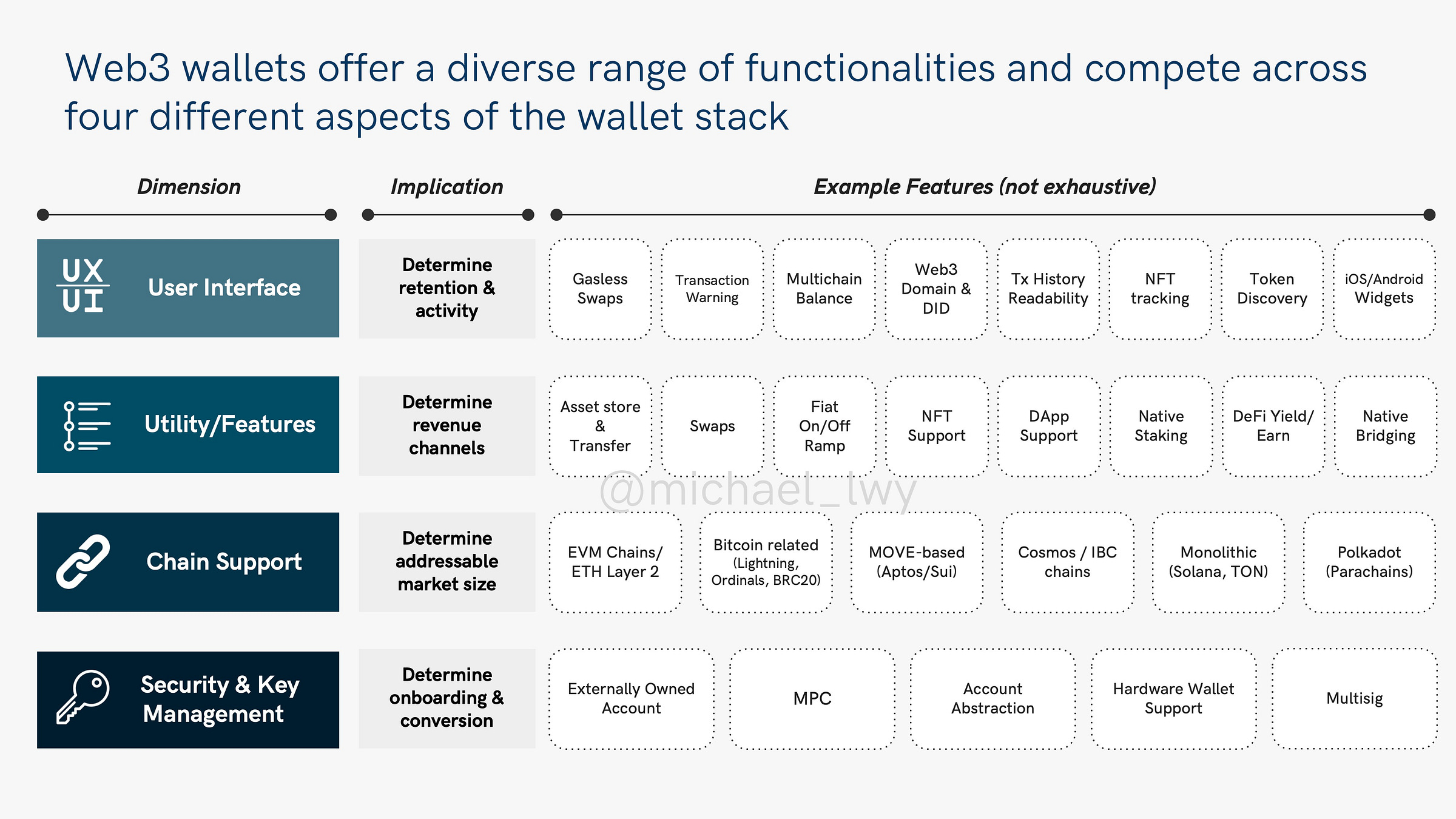

In the second framework, I draw inspiration from Messari’s @kelxyz_. He segmented the wallet stack into four components: 1) Key Management, 2) Blockchain Connectivity, 3) User Interface, and 4) Application Logic. Building on this foundation, I delve deeper into the strategic implication of the different stacks. In Kel’s analysis, the four dimensions are described as distinct elements that, when combined together, determines a wallet’s accessibility, specialization, and business focus.

In my version, the wallet stack is more of a layered cake with security & key management being the most important dimension at the bottom of the stack. Based on the solid design in the lower layers, a wallet could focus on more ornamental UI tweaks that improve user retention on the top layers. Features in each layer have specific implications for the product strategy regarding onboarding, conversion, monetization and retention.

❶ Security & Key Management: Self-custody is the most crucial characteristic of web3. This dimension focuses on how wallets manage private keys and ensure security. Features here range from multi-party computation (MPC), hardware wallet support, multi-sign functionalities to social logins powered by Account Abstraction. The elements centered around key management shape the wallet's onboarding journey and its success in converting new users.

❷ Chain Support: Wallets can distinguish themselves by the chains they support. While some focus on the Ethereum ecosystem (L2 and EVMs), others cater to Bitcoin-related protocols (BRC-20 & Ordinals), Cosmos chains or monolithic chains chains like Solana and TON. Essentially, the chain compatibility of a wallet defines its potential market reach.

❸ Utility: This dimension emphasizes the core functionalities that set wallets apart. Examples include facilitating basic asset transfers to supporting dApps, native staking, and NFT management. The wallet's utility spectrum establishes its revenue streams. Most wallets now provide table stake offering like swap and fiat on-ramp. The ability to stand out therefore depends on the improvements made in the next layer.

❹ UI/UX: Serving as the initial interface, the UI/UX orchestrates how users interact with the wallet. This layer includes elements such as gasless swaps, transaction alerts, display logic of multi-chain balance, and the integration of web3 domains with decentralized identities (DID). This dimension shapes the primary user activities within the app.

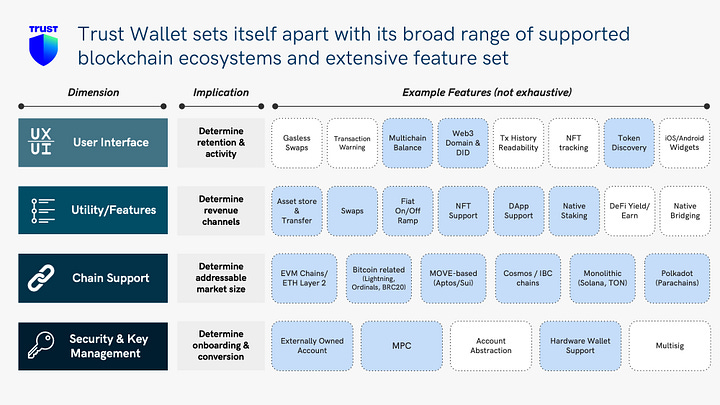

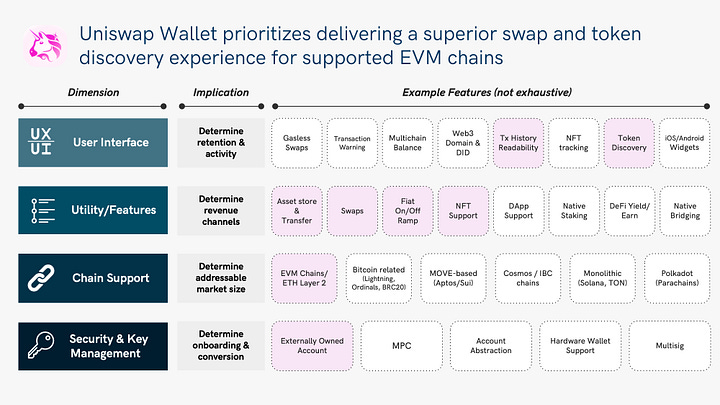

Let’s now look at two examples: one from the top left quadrant, Trust Wallet, and the other from the bottom right, Uniswap Wallet.

Trust Wallet epitomizes a "fat wallet." It boasts a comprehensive suite of features spanning nearly all four facets of the stack. Particularly notable is its robust support for almost every chain ecosystem. In contrast, Uniswap Wallet adopts a ‘leaner’ approach. Its design and functionalities are distinctly tailored for the trading experience, making it a more specialized tool.

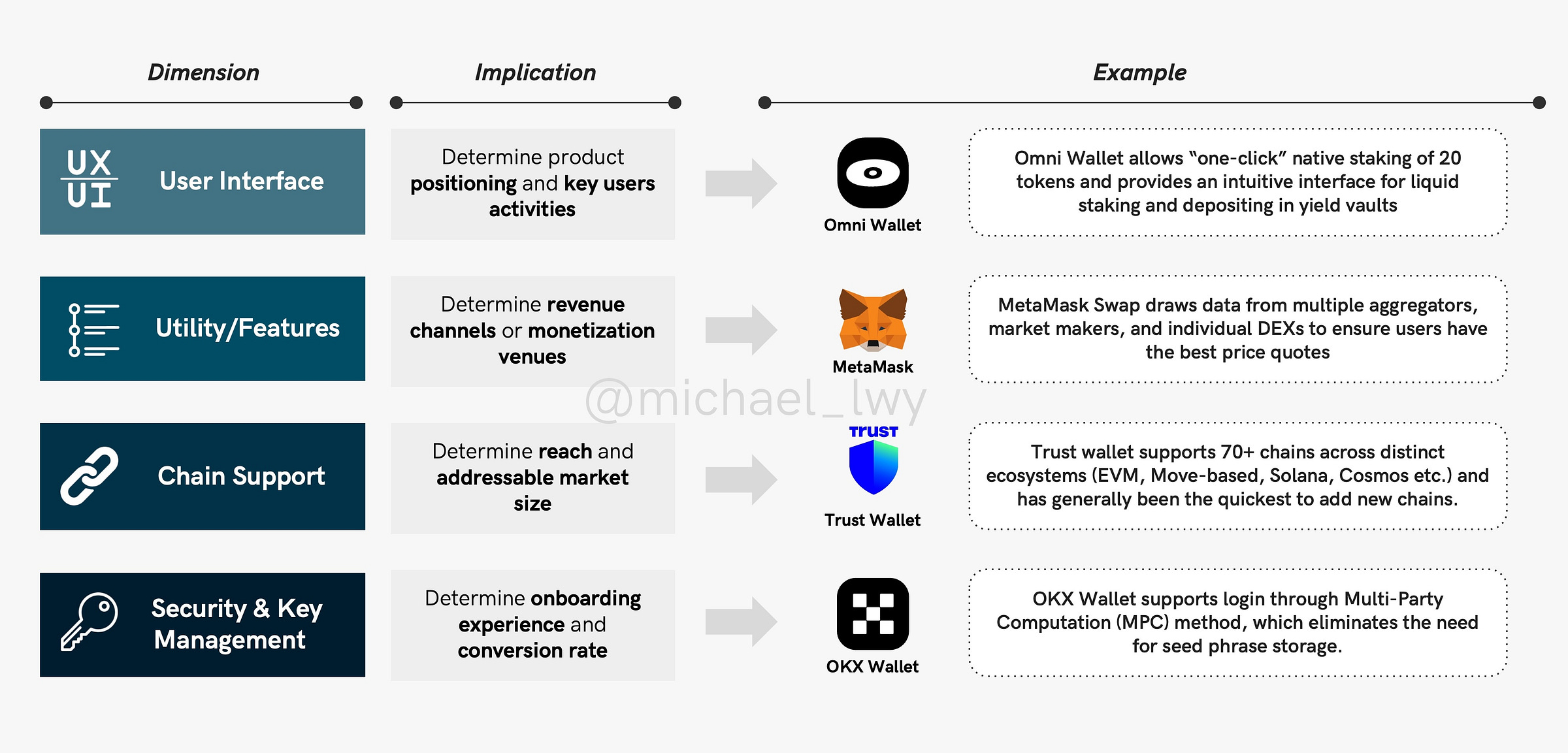

Here we have a few more examples to elucidate how different wallets position themselves distinctively within a particular dimension.

Omni Wallet, formerly known as Steakwallet, emphasizes native staking. It delivers a simple UX for facilitating native staking of 20+ tokens. From the outset, Omni’s mission was clear: to carve a unique space spotlighting DeFi yields opportunities in staking, liquid staking, and yield vaults.

Metamask operates its swap function as a meta-aggregator, sourcing liquidity from DEXs, DEX aggregators, and market makers. This strategy ensures users receive the best price quotes. In return users pay Metamask a 0.875% swap fee for the aggregation service.

Trust Wallet stands out for its extensive chain support. It backs over 70 chains across varied ecosystems, including EVM, Move-based chains, Cosmos, and standalone chains like Solana and TON.

OKX Wallet has been directing its strategy towards enhancing user onboarding and conversion. They introduced MPC-based social logins, allowing users to create a wallet using their email. This feature bypasses the step of noting down a 12-word seed phrase, a common barrier for those new to crypto.

III. Monetizability and Substitutability

Another useful framework to evaluate a wallet product is to look at its features’ monetizability and substitutability.

Monetizability is the revenue-generating potential of a feature within the wallet. For instance, certain features like fiat on-ramps, token swaps, and bridging can readily generate revenue by incorporating an additional platform fee. Features associated with staking and DeFi earnings can have a portion of the rewards allocated as platform fees. Beyond the realm of asset management, dapp-related functionalities, such as a dapp discovery/marketplace, present another revenue stream: platforms can charge advertising fees to elevate the visibility of certain dapps.

Substitutability underscores the competitive differentiation of a feature. It gauges how distinctly a product or service sets itself apart from competitors and its replacaebility. Basic utilities like token transfers, transaction history, and swaps are table-stake offerings found across most wallets. However, specialized features like staking and gas subsidies offer a more formidable moat - when a user decides to stake assets using a particular wallet, they’re more inclined to come back to the same wallet for subsequent on-chain fund management. The social features are another example: features like community feeds and web3 profiles, as seen in Halo Wallet and Easy Wallet, foster user connectivity. Once users establish their social connections within a platform, they are tied in to its network effect.

Based on the 3 frameworks above, we can see how it is important for builders and investors in the wallet space to ask the following questions:

Where does the wallet sit on the spectrum of ecosystem coverage and feature specificity? Which quadrant does it approximately occupy in the first framework? Is there a focus on certain blockchains or use cases? Who are the significant competitors in their proximity on the map?

Which layer of the wallet stack is the project emphasizing? Does it introduce meaningful differentiation and superior functionalities that widen the scope of each layer? Among the factors of user conversion, market reach, revenue generation, and user retention, which ones are given precedence?

Lastly, how does the wallet’s feature set fare when plotted against monetizability and substitutability? What level of competitive moat does the feature possess?

2 trends to look out for

Finally I would like to highlight two key trends that are still playing out. These developments could dramatically shift the wallet landscape in the future.

Embedded Wallets.

One of the the developments to look out for is the rise of embedded wallets - many dapps are increasingly choosing to vertically integrate wallet functionalities. Take the recent rise of Friend.Tech and its forks as an example. Traditionally, they would have had users connect to the dapp via Metamask or WalletConnect. But in order to abstract away the seed phrase requirement for new users, Friend.Tech incorporated embedded wallets utilizing Privy’s infrastructure.

This shifts the paradigm from “one wallet for ALL dapps” to “one wallet for EACH dapp.” Instead of using a single application to manage assets, users may end up with multiple addresses and balances for various dapps they use, challenging the ‘fat wallet’ thesis and hinting at a more fragmented wallet ecosystem. If we consider Friend.Tech as a wallet, it would be plotted somewhere to the very bottom right in the first framework: its use case is specific to managing friend.tech keys and its chain focus is solely on Base.

Consequently, the ‘traditional’ wallet could see its value proposition diminish with the advent of Wallet-as-a-Service (WaaS) offerings from Privy, Coinbase WaaS, Web3Auth, Magic Link, Ramper, Unipass, Dynamic, Sequence, Particle, ZeroDev and Biconomy, to list a few. Instead, dapps could encroach upon the territory of wallet apps, incorporating wallet functionality as an ancillary feature and capturing a slice of the market share once dominated by standalone wallets.

Wallet’s role in MEV supply chain

This article has primarily explored the wallet landscape as an independent sector, but it’s also important to consider the role of wallets within the broader context of the MEV (Maximal Extractable Value) supply chain. Wallets are powerful gatekeepers in this ecosystem, compiling user intents into on-chain actions. They determine the routing of transactions—whether through the public mempool or private RPC like MEV-Blocker (used by Uniswap Wallet), Flashbots Protect (used by OKX wallet), and Blink, which regulate searchers’ strategies, such as prohibiting frontrunning and sandwiching.

The value of user order flow in the MEV supply chain should not be underestimated. While much attention has been paid to the substantial swap fees accumulated by Metamask Swap, a frequently overlooked detail is that Metamask’s default RPC endpoint is Infura. And you guessed it, both Metamask and Infura are owned by the same parent company, ConsenSys. To put simply:

Who controls the wallet, controls the RPC endpoint.

Who controls the RPC endpoint, controls the orderflow.

Who controls the orderflow, controls MEV extraction.

This cascade of control highlights the strategic significance of wallets far beyond their user interface or asset management capabilities. They are central to the MEV supply chain, wielding influence over the user’s transaction journey. Threfore, the competition between searchers over valuable transactions will give wallets leverage in monetizing via Payments for Order Flow (PFOF).

P.S.

After posting this article, I came across the news that Stelo, a wallet companion plugin designed to enhance web3 security through transaction simulations and warnings, decided to sunset the protocol. They had previously announced $6M fundraising from a16z earlier this year. One of the reasons they quoted is that “many of the most promising use cases of crypto — gaming, decentralized social, and stablecoins – will likely have embedded wallets that abstract the complexity and risk of using dedicated wallets away from the user.” Incorrect positioning does in fact make or break companies.