Will stablecoins become the largest holders of US treasuries?

Two weeks ago Fred Ehrsam posted the question “Will stablecoins become the largest holders of US treasuries?” on Farcaster through Bountycaster. I’m happy to share that my submission has been selected as one of the winners of this bounty. I would like to share the response I wrote with you below.

The stablecoin market cap stands at around $150 billion today, with the top three fiat-backed issuers dominating the market share. According to Tether's latest disclosure, the company holds $81.5 billion in U.S. Treasuries and reverse repurchase agreements. Circle's USDC has approximately $25.7 billion invested in Treasuries or reverse repos. First Digital's FDUSD stablecoin holds $1.6 billion in similar assets. Collectively, these three major stablecoin issuers have amassed $108.8 billion worth of U.S. Treasuries and reverse repo agreements.1

With $108.8 billion in treasuries, stablecoin issuers would collectively rank as the 20th largest holder of U.S. Treasuries today, just behind Germany.

Assuming a 10x growth in stablecoin market cap to $1 trillion over the next decade, and a similar reserve composition of 82%, stablecoin issuers could potentially hold around $820 billion in Treasuries in 10 years.

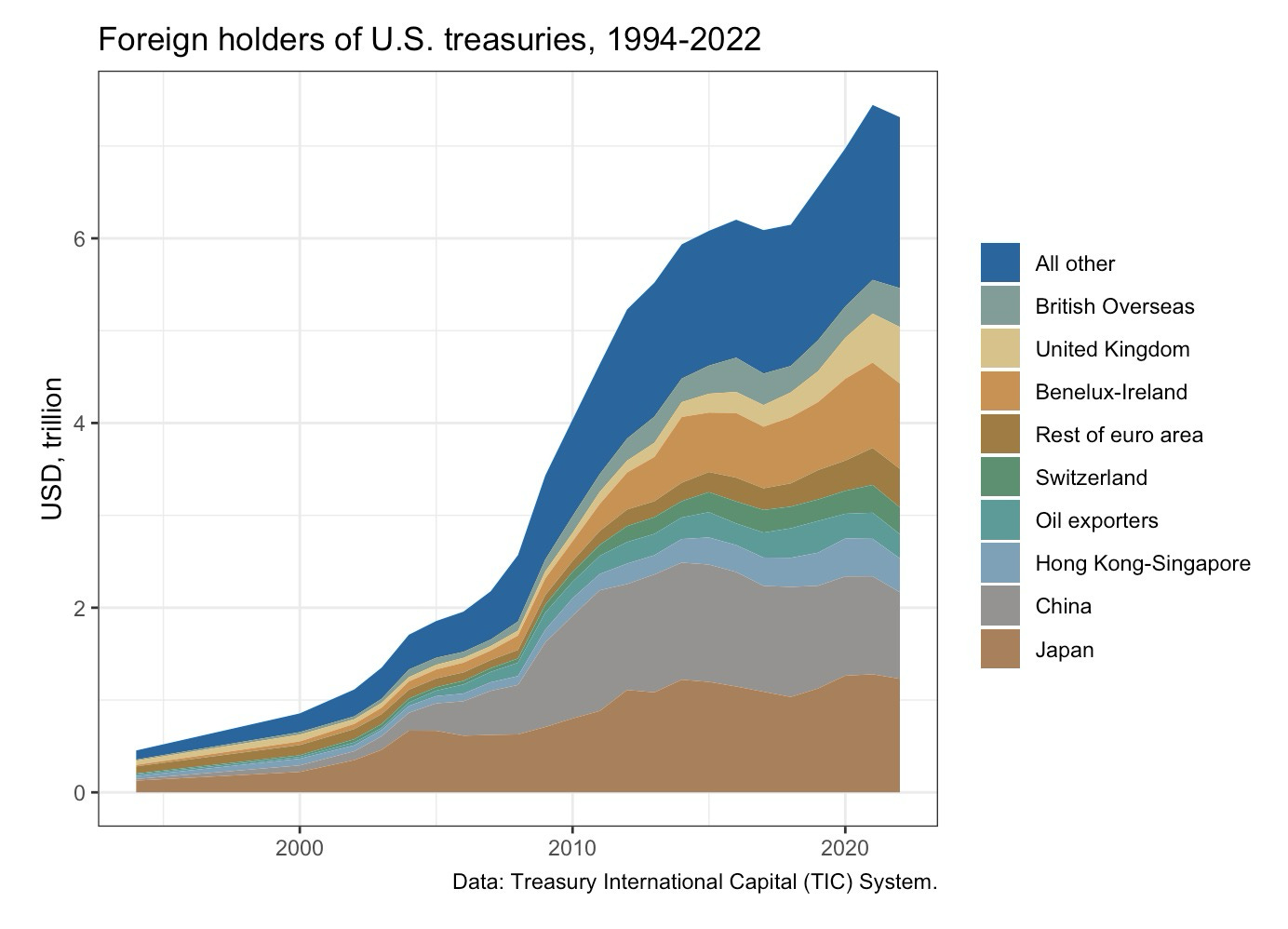

Looking at the current ownership structure of U.S. debt, the Federal Reserve remains the largest holder of public debt. Of the $21 trillion in privately held debt, 65% is domestically owned, while 35% is held by foreign entities and investors.

Over the next decade, federal debt levels are projected to rise. According to the Congressional Budget Office (CBO), U.S. public debt is expected to reach $48 trillion by 2034, an 84% increase from the current $26 trillion. Of this $48 trillion, the CBO anticipates the Federal Reserve will hold $9.3 trillion, leaving $38.7 trillion in privately held debt. Assuming foreign ownership maintains its current 35% share, total foreign-held U.S. Treasuries would stand at $13.5 trillion in 2034, an 87% surge from today's $7.2 trillion. Assuming the composition of foreign ownership by then resembles today’s ranking, stablecoins' projected $820 billion holding would position it as the 4th-largest holder, behind Japan, China, and the UK.

The ownership structure of privately held U.S. Treasuries are divided into two main categories: domestic holders and foreign holders. The domestic holders include entities like mutual funds, insurance companies, banks, and individual investors within the US. Foreign holders comprise central banks, sovereign wealth funds, and other individual investors from outside the U.S.

When it comes to stablecoins and their reserves, it's important to understand that these issuers don't necessarily hold treasuries directly. Instead, they utilize third-party asset managers or custodians to manage their reserves.

For example, Circle's reserves are managed by BlackRock through the Circle Reserve Fund. In this case, the Treasuries held as part of Circle's reserves would likely be counted under the "Mutual Funds" category within domestic holders, as BlackRock is a U.S.-based asset manager.

On the other hand, if a stablecoin issuer like Tether holds its reserves offshore, those Treasuries would likely be classified under foreign holders, as they are held by a non-U.S. entity.

Therefore, instead of creating a separate category for "stablecoins" in the ownership structure, it's more accurate to consider where the actual Treasuries are held and by whom. They would be distributed across various existing categories, both domestic and foreign, based on the custodians or asset managers involved.

The more relevant question is: What will drive the demand for stablecoins in the future? If the demand primarily comes from foreign individuals seeking easier access to the U.S. dollar (i.e. dollarization in emerging markets), it could indirectly increase the foreign ownership of Treasuries, as stablecoin issuers would need to hold more Treasuries to back the increased stablecoin supply.

However, if the demand for stablecoins is predominantly from domestic users looking for an alternative or replacement to physical cash or bank deposits, it may not significantly impact the foreign ownership structure, as the underlying Treasuries held by stablecoin issuers would likely fall under existing domestic holder categories.

So rather than treating stablecoins as a separate entity in the ownership structure, it's more accurate to consider where their underlying Treasury holdings are custodied. The key factor is understanding the sources of future stablecoin demand.

Some additional thoughts

One barrier to the adoption of stablecoins as a replacement for cash and bank deposits is that this would be a significant departure from today's financial system, where commercial banks play a central role in money creation.

Currently, the system operates on a two-tiered monetary system: one type of money is used when transacting with the Fed and between commercial banks (reserves), and another type is used when transacting with everyone else (bank deposits). Credit intermediation by banks is literally what creates money today. Banks engage in maturity transformation, where they borrow short-term funds from depositors and lend long-term funds to borrowers. This creates a maturity mismatch between their assets and liabilities, making them vulnerable to liquidity risk. This is why periodic bank runs are inevitable. While banking and liquidity management regulations exist, the structural design is inherently unstable.

So, if it's risky, why are we still doing it? Banking rests on an illusion, in which banks transform risky assets (loans, securities trading) into risk-free liabilities (deposits). People give money to banks expecting the money to be absolutely safe, and then the banks engage in risky activities with it. But one could also argue that this is an essential process of credit creation that creates economic growth, and maybe as a side effect, boom-and-bust business cycles.

If stablecoins become widely adopted, it means we are shifting to a model of full reserve banking, as all circulating stablecoins are supposed to be backed 1:1 by treasuries or central bank reserves (not playing the “borrow short, lend long” game). This essentially dis-intermediates the role of banks. People would directly hold the liability of the government instead of the liability of commercial banks. This concept is also referred to as "narrow banking." This would be a significant departure from the model that has been working for the past 100 years.

Why don't we just implement full reserve banking, back everything 1:1, and create a safe system where bank runs are impossible? In fact, people have tried. There have already been attempts to create a bank called The Narrow Bank (TNB), which promises to do just that – hold checking accounts for people and park them at the Fed as central bank reserves. But ironically, this idea has not been entertained because, I quote: "narrow banks generally can 'complicate the implementation of monetary policy' and 'could disrupt financial intermediation' and 'could also have a negative effect on financial stability.'"

I think if we envision a future where stablecoins are what people use every day for transactions and replace most physical cash and deposits (M0 and M1 money supply, which are upwards of $16 trillion today), there needs to be a seismic shift from a regulatory perspective and serious conversations about the full reserve banking model originally imagined by the Chicago Plan and in “100% Money” by Irving Fisher.

Reference and Sources:

Tether USDT (Market Cap: $102 billion)

According to 2023 December report, Tether holds $63 billion in US T-bills, $10.2 billion in Reverse Repo and $8.3 billion in Money Market Funds.

Circle USDC (Market Cap: $29.3 billion)

Most of the reserves of USDC is held at Circle Reserve Fund managed by BlackRock. $25.7 billion are in Repo or US treasuries.

First Digital FDUSD (Market Cap $2.8 billion)

US Treasuries held around $1.6 billion, others in Fixed term bank deposits.

CBO project of Public Debt in 2034

Foreign holders of US treasuries 1994-2022

Note: A reverse repo transaction is a form of short-term lending. In this arrangement, Tether lends cash to a counterparty and receives U.S. Treasuries as collateral. The counterparty agrees to repurchase these securities at a later date, often overnight or within a few days, at a slightly higher price, effectively paying interest on the cash borrowed. For simplicity, we count these as treasuries holdings as well.